Trump Reverses Course, But 125% Tariffs on China Hit

G

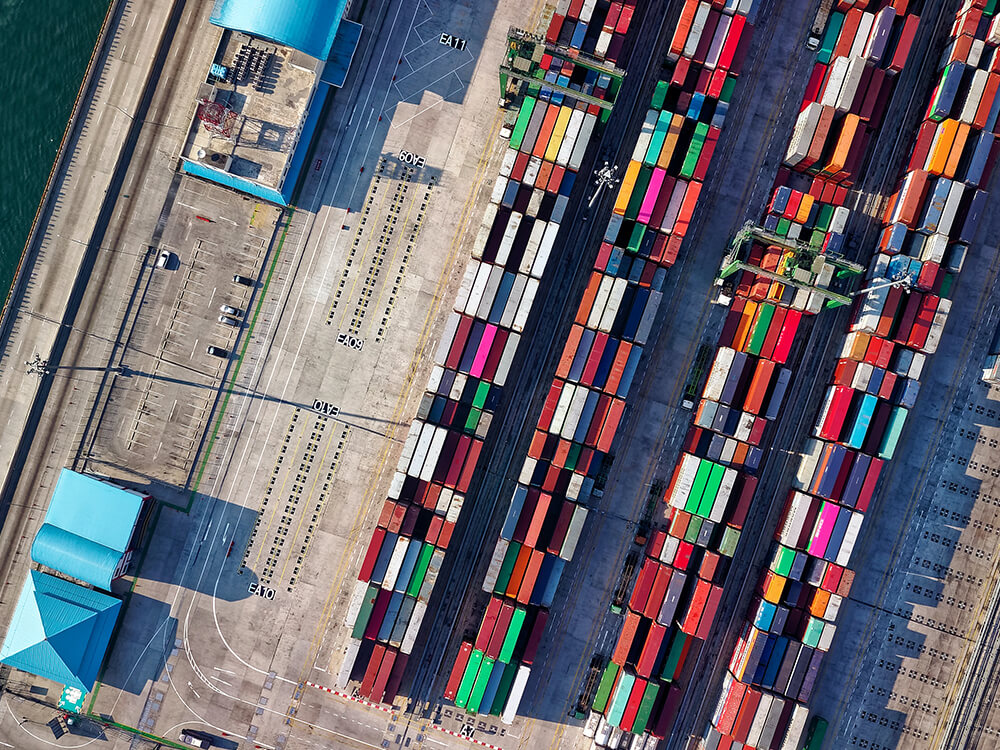

Global markets experienced a significant rebound following a reversal of some Trump-era trade policies. However, the relief was tempered by the immediate implementation of a 125% US tariff on select Chinese goods. This unexpected development highlights the ongoing volatility in the US-China trade relationship and its global impact.

The initial market reaction to the partial policy reversal was positive, with major indices showing gains. Investors had anticipated further escalation of trade tensions, and the change in direction, albeit partial, provided a sense of cautious optimism. However, the simultaneous imposition of the substantial new tariffs quickly dampened this enthusiasm.

Analysts are divided on the long-term consequences of this mixed signal. Some believe that the partial rollback is a sign of a softening stance from the administration, while others see it as a tactical maneuver with potentially more aggressive actions to follow. The 125% tariff, particularly, is viewed as a significant escalation, targeting key sectors of the Chinese economy and potentially impacting global supply chains.

The implementation of these tariffs could lead to increased prices for consumers in the US, as well as retaliatory measures from China. This could further destabilize the global economy, already facing challenges from inflation and geopolitical uncertainty. Businesses are left navigating a complex and unpredictable landscape, forcing them to adapt to constantly shifting trade rules and potential cost increases.

The impact on specific industries will vary, with some sectors potentially facing significant disruption. The long-term effects remain uncertain, dependent on future policy decisions from both the US and China. The current situation underscores the urgent need for stable and predictable trade relations to foster global economic growth and stability. The coming weeks and months will be crucial in determining the full extent of the economic consequences of this latest development.